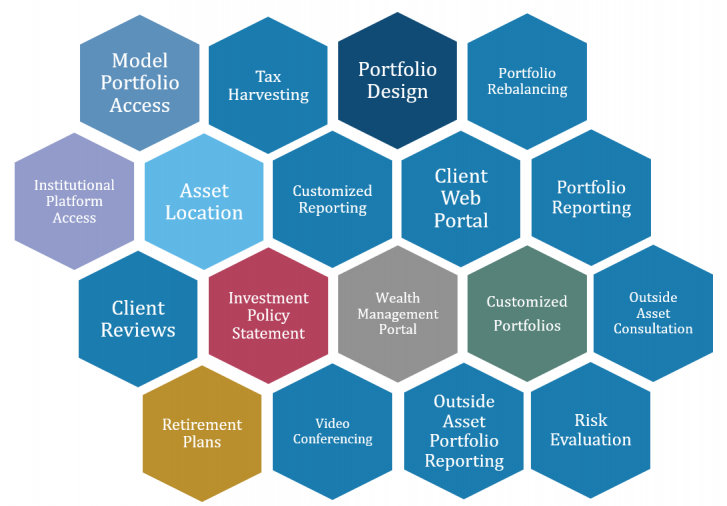

We have one of the most versatile portfolio management platforms nationwide. Portfolio management is offered utilizing the institutional investment platforms of Charles Schwab & Co., Fidelity Investments, TD Ameritrade, and Interactive Brokers.

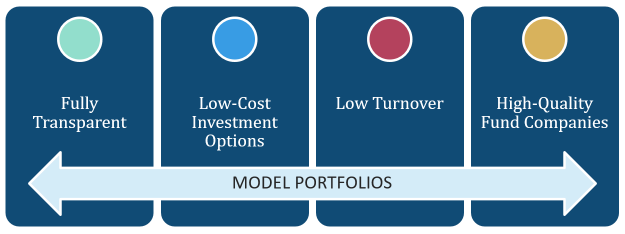

Our Model Portfolios are designed to emphasize market segments of higher expected returns, minimize turnover and reduce overall expenses.

- Highly diversified and efficient, these comprehensive solutions are designed to serve a wide range of investor needs.

Model Portfolios can be used as core strategies or as building blocks to create the ideal portfolio for the client. Detailed information for each Model Portfolio can be found on our Model Folio page, including holdings, model allocation, benchmark allocation and historical performance published monthly.

In addition to our Model Portfolios, we also offer Customized Portfolios.

Built on a Nobel Prize-winning framework, we provide a Risk Evaluation for each client using our Risk Alignment Tool that quantifies the semantics of the financial advice industry, replacing confusing and subjective terms like “moderately conservative” and “moderately aggressive” with the Risk Number, a number between 1 and 99 that pinpoints a client’s exact comfort zone for downside risk and potential upside gain. We then build an investment portfolio to match the client’s Risk Number and chart a clearly defined path to the client’s goals.

Capture Your Risk Number – The first step is to answer a 5-minute questionnaire that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. Then we’ll pinpoint your exact Risk Number to guide our decision making process.

Align Your Portfolio – After pinpointing your Risk Number, we’ll craft a portfolio that aligns with your personal preferences and priorities, allowing you to feel comfortable with your expected outcomes. The resulting proposed portfolio will include projections for the potential gains and losses we should expect over time.

We construct an Investment Policy Statement for every client to provide the following:

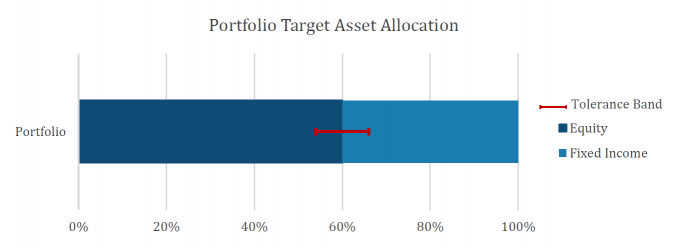

We utilize a Tolerance-Based System for rebalancing when a position deviates too far from its target allocation. The Tolerance-Based System uses tolerance bands based on a specific percentage, typically 10% for major asset classes. The chart below shows an example of a portfolio allocated to 60% equities. The portfolio would only require equity rebalancing if the equity allocation exceeded the tolerance band threshold by either increasing to 66% or decreasing to 54% of the portfolio allocation.

These rebalancing procedures also apply to sub-asset classes (20% tolerance band) in the allocation and our monitored daily by our portfolio management system. Typically, minor rebalancing is only necessary once every 9 to 12 months and does not cause significant capital gains issues.

We provide all clients quarterly performance reports for each portfolio through the client’s online web portal. Our performance reports are generated utilizing industry recognized Morningstar Office software. Performance of your accounts will be compared to a comparative benchmark index using the appropriate major indices. We also provide other types of reports at the request of the client.

Below are samples of reports we provide our clients: