| Annualized | |||||||

|---|---|---|---|---|---|---|---|

| YTD 2017 (SEP) |

1 Year 2016 |

3 Yrs 2014-2016 |

5 Yrs 2012-2016 |

10 Yrs 2007-2016 |

15 Yrs 2002-2016 |

20 Yrs 1997-2016 |

|

| Folio 100 | 13.22% | 15.11% | 5.86% | 12.76% | 5.52% | 9.63% | 9.65% |

| Benchmark Index | 12.57% | 14.67% | 6.15% | 12.24% | 5.22% | 8.89% | 8.56% |

| Annual | ||

|---|---|---|

| Folio 100 | Benchmark Index | |

| 1997* | 19.21% | 17.68% |

| 1998* | 7.14% | 7.77% |

| 1999* | 18.61% | 14.65% |

| 2000* | 4.57% | 1.64% |

| 2001* | 0.50% | -2.61% |

| 2002* | -8.69% | -10.59% |

| 2003* | 46.33% | 41.80% |

| 2004* | 23.79% | 22.07% |

| 2005* | 12.53% | 11.48% |

| 2006* | 24.64% | 25.06% |

| 2007 | 3.04% | 2.92% |

| 2008 | -41.09% | -39.50% |

| 2009 | 37.69% | 34.47% |

| 2010 | 20.81% | 18.03% |

| 2011 | -7.05% | -5.48% |

| 2012 | 19.94% | 18.75% |

| 2013 | 28.35% | 25.41% |

| 2014 | 6.25% | 7.39% |

| 2015 | -3.02% | -2.88% |

| 2016 | 15.11% | 14.67% |

| Benchmark Index | |

|---|---|

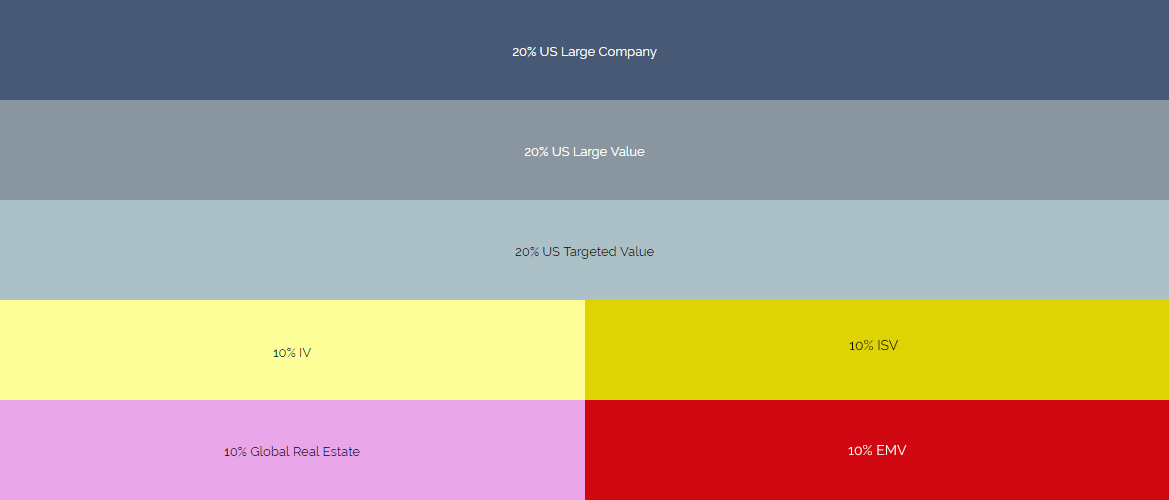

| S&P 500 Index | 20.00% |

| Russell 1000 Value Index | 20.00% |

| Russell 2000 Value Index | 20.00% |

| Dow Jones U.S. REIT Index | 5.00% |

| MSCI EAFE Value Index | 10.00% |

| MSCI EAFE Small Value Index | 10.00% |

| S&P Global ex US REIT Index | 5.00% |

| MSCI Emerging Markets Value Index | 10.0% |

| Folio 100 | Benchmark Index | |

|---|---|---|

| Mean Return | 11.43% | 10.14% |

| Median Return | 13.82% | 13.07% |

| Worst Return | -41.09% | -39.50% |

| Best Return | 46.33% | 41.80% |

| Negative Returns | 4 | 5 |