| Annualized | |||||||

|---|---|---|---|---|---|---|---|

| YTD 2017 (SEP) |

1 Year 2016 |

3 Yrs 2014-2016 |

5 Yrs 2012-2016 |

10 Yrs 2007-2016 |

15 Yrs 2002-2016 |

20 Yrs 1997-2016 |

|

| DFA Global Equity Folio | 12.49% | 17.30% | 5.63% | 13.01% | 5.81% | 9.96% | 10.09% |

| Benchmark Index | 12.10% | 17.67% | 6.09% | 12.45% | 5.47% | 9.10% | 8.78% |

| Annual | ||

|---|---|---|

| DFA Global Equity Folio | Benchmark Index | |

| 1997* | 20.35% | 18.13% |

| 1998* | 4.63% | 4.53% |

| 1999* | 19.20% | 13.37% |

| 2000* | 5.99% | 24.00% |

| 2001* | 3.21% | 0.10% |

| 2002* | -8.90% | -10.99 |

| 2003* | 49.40% | 43.85% |

| 2004* | 24.25% | 22.23% |

| 2005* | 12.76% | 11.26% |

| 2006* | 23.87% | 24.72% |

| 2007 | 2.53% | 2.12% |

| 2008 | -40.15% | -38.02% |

| 2009 | 38.19% | 34.33% |

| 2010 | 22.38% | 19.26% |

| 2011 | -8.03% | -6.62% |

| 2012 | 19.54% | 18.56% |

| 2013 | 30.84% | 27.00% |

| 2014 | 4.48% | 5.63% |

| 2015 | -3.83% | -3.94% |

| 2016 | 17.30% | 17.67% |

| Benchmark Index | |

|---|---|

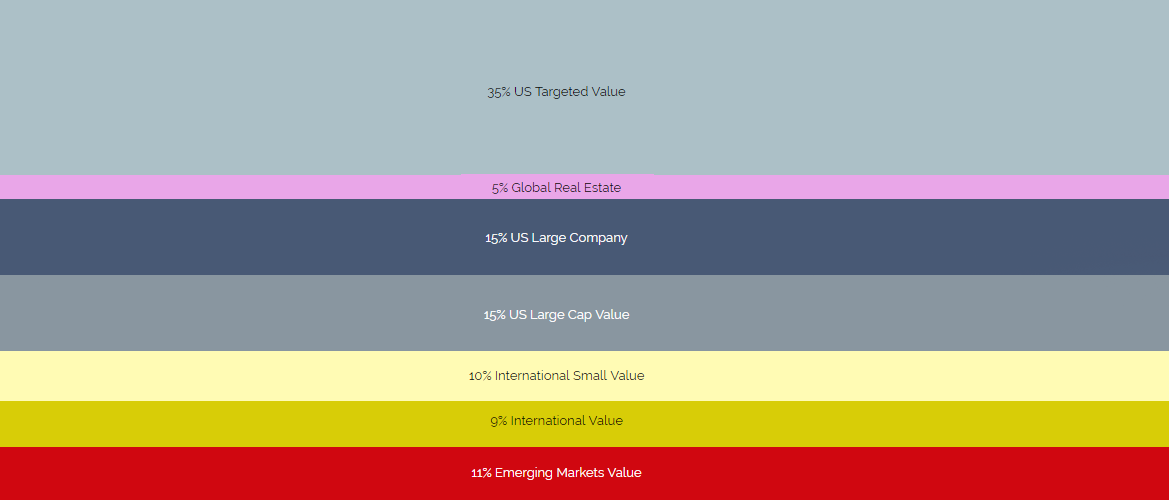

| S&P 500 Index | 15.00% |

| Russell 1000 Value Index | 15.00% |

| Russell 2000 Value Index | 35.00% |

| Dow Jones U.S. REIT Index | 2.50% |

| MSCI EAFE Value Index | 9.00% |

| MSCI EAFE Small Value Index | 10.00% |

| S&P Global ex US REIT Index | 2.50% |

| MSCI Emerging Markets Value Index | 11.00% |

| DFA Global Equity Folio | Benchmark Index | |

|---|---|---|

| Mean Return | 11.90% | 10.36% |

| Median Return | 15.03% | 12.32% |

| Worst Return | -40.15% | -38.02% |

| Best Return | 49.40% | 43.85% |

| Negative Returns | 4 | 4 |