AQR is a global investment management firm built at the intersection of financial theory and practical application. AQR strives to deliver superior, long-term results for our clients by looking past market noise to identify and isolate what matters most, and by developing ideas that stand up to rigorous testing. Their focus on practical insights and analysis has made them leaders in alternative and traditional strategies since 1998.

AT A GLANCE

-

- AQR takes a systematic, research-driven approach to managing alternative and traditional strategies

-

- Apply quantitative tools to process fundamental information and manage risk

-

- The firm has 30 principals and 764 employees; nearly half of employees hold advanced degrees

-

- AQR is based in Greenwich, Connecticut, with offices in Boston, Chicago, Hong Kong, London, Los Angeles, and Sydney

-

- Approximately $175.2 billion in assets under management as of December 31, 2016*

INVESTMENT PHILOSOPHY

AQR’s investment philosophy is based on three core principles informed by decades of research and experience. By applying these principles, AQR seeks to deliver sustainable, long-term value for investors.

A Systematic Approach: Through extensive research, AQR strives to identify long-term, repeatable sources of expected returns grounded in sound economic theory. Their insights are then implemented in a disciplined manner to reduce subjective biases.

Diversification: Diversification can be used to reduce overall risk of investor portfolios and improve risk-adjusted returns. AQR diversifies across multiple dimensions — asset classes, strategies and time — to minimize uncompensated risks and achieve more consistent results for investors.

Craftsmanship: Across all investment strategies, AQR seeks additional alpha through portfolio construction, risk management and proprietary trading technology. They include both qualitative and quantitative tools and are meticulous in every detail of the investment process.

WHAT ARE LIQUID ALTERNATIVES?

-

- Hedge funds are private vehicles that seek to provide returns that are uncorrelated to traditional sources of returns like stocks and bonds

- Liquid alternatives are hedge fund strategies that are packaged in daily valued, liquid funds

- Many, but not all hedge fund strategies can be managed in daily valued funds

WHY INVEST IN ALTERNATIVES?

-

- Low correlations / greater diversification

- Positive convexity / hold up in declining and rising equity markets

- Have alternative sources of returns

- These strategies should be intuitive, persistent, and diversifying

- Transparent investment strategy

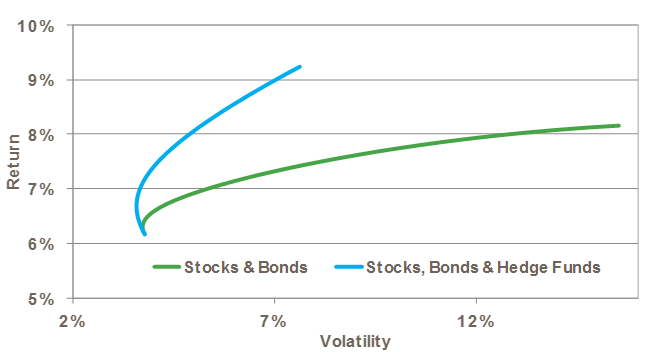

Efficient Frontier

Source: Hedge Funds: CS Total Hedge Fund Index, Stocks: S&P 500, Bonds: Barclays Capital Aggregate. For illustration only. Past performance is not an indication of future results. For each level of volatility, we optimize for the highest return portfolio. Each point on the line is a different allocation to stocks, bonds and hedge funds.